Blog

A medical billing audit is necessary for all healthcare providers to help reduce and catch errors that could lead to denied claims, revenue leakage, investigations, and, most importantly, lost or unhappy patients.

This short blog explains what medical billing audits are, who conducts them, how to improve your current audit process, and how they can benefit your medical practice.

What Is A Medical Billing Audit?

A medical billing audit analyzes the efficiency of a provider’s clinical documentation and medical billing process. It checks all the health records kept by a medical practice and looks at the billing info sent to insurance companies and payers. This makes sure the practice is dealing with billing mistakes and fixing them. Since billing is tied to profits, spotting and correcting mistakes prevents your practice from losing revenue and reputation with payers. These audits can happen before sending claims (prospective) or after (retrospective).

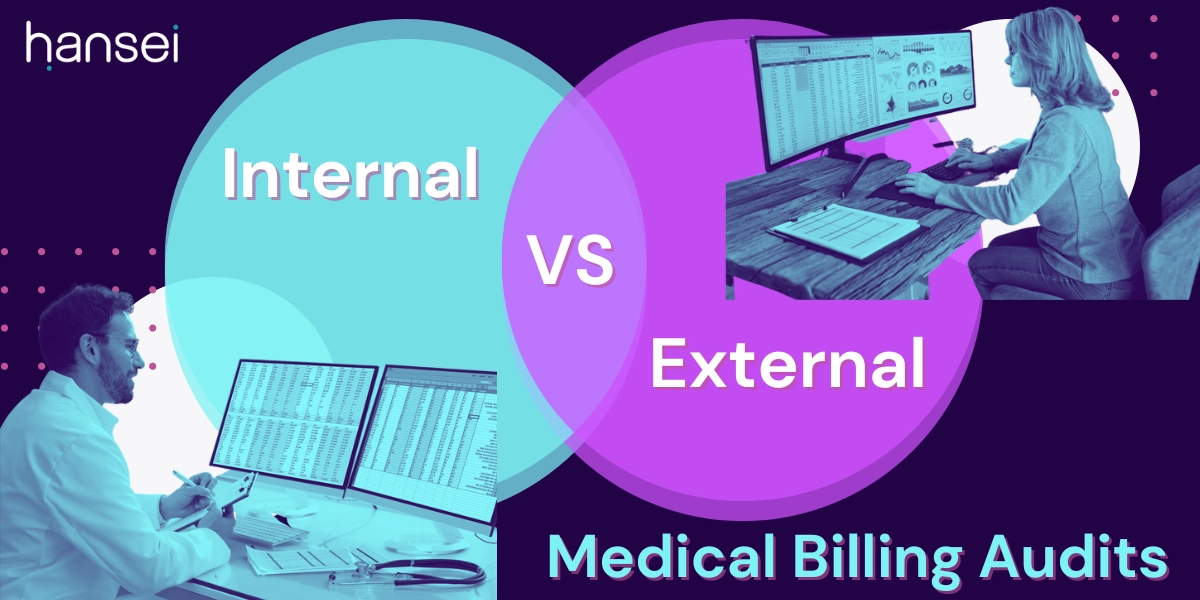

Medical billing audits can be done by the practice itself to improve things or by an outside group to make sure the practice is doing things properly. During an audit, the practice might need to share clinical records like medical files, X-rays, and lab results; financial records like accounts receivables and charge sheets; and documents that show the practice’s policies. However, external audits don’t replace internal audits completely. Doing a separate outside audit every year is also useful for bigger providers that perform regular internal audits.

Read more: Top 3 Medical Billing Mistakes That Lead To Claim Denials

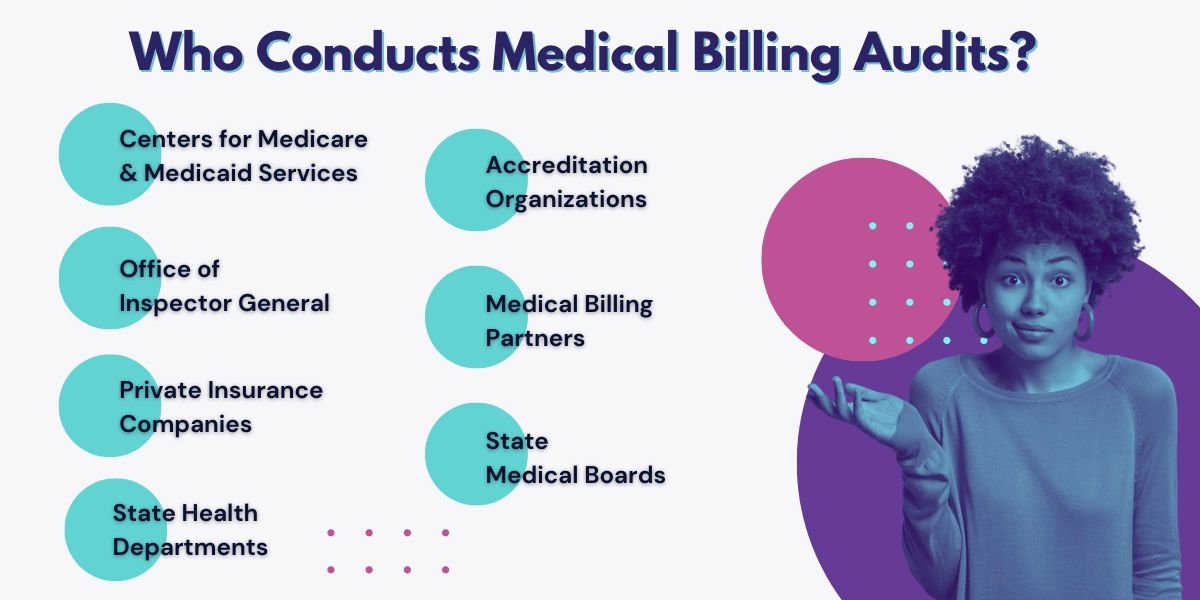

Who Conducts Medical Billing Audits?

Besides an internal medical billing department, there are several organizations and entities that perform audits in the U.S. healthcare system to ensure that coding, billing, legal, and ethical standards are followed. These include:

Centers for Medicare & Medicaid Services (CMS): CMS is a federal agency within the U.S. Department of Health and Human Services that administers Medicare and Medicaid programs. It conducts audits to ensure that healthcare providers participating in these programs adhere to regulations and guidelines.

Office of Inspector General (OIG): The OIG is an independent agency within the U.S. Department of Health and Human Services responsible for investigating fraud, waste, and abuse in federal healthcare programs. It conducts audits and inspections to identify non-compliance and unethical practices.

Private Insurance Companies: Insurance companies that provide health coverage often conduct audits of healthcare providers to ensure that the services billed are accurate, medically necessary, and compliant with the terms of the insurance policy.

State Health Departments: State health departments may perform audits to ensure compliance with state regulations and standards in healthcare facilities, including hospitals, clinics, and long-term care facilities.

Accreditation Organizations: Organizations like The Joint Commission (TJC) and the Healthcare Facilities Accreditation Program (HFAP) conduct audits to assess the quality and safety of healthcare facilities. Their focus is on ensuring that facilities meet certain standards to maintain accreditation.

Medical Billing Partners: Medical billing companies specializing in conducting audits and assessments can help healthcare providers comply with regulations, ethical standards, and best practices while having enough time to look after patients.

State Medical Boards: State medical boards oversee the practice of medicine within their jurisdictions. They may conduct audits or investigations if there are concerns about a healthcare provider’s ethical or legal conduct.

Read more: How To Find The Right Medical Billing Company In California

How To Improve Your Medical Billing Audit Process

You can improve your internal medical billing audit process by performing daily and weekly checks and using a checklist based on your practice’s specialty. The basic checklist should include:

Focusing on growth:

- Reviewing your billing practices helps identify discrepancies and trends over time, including duplicate claims or vague treatment plans.

- Designate skilled individuals or organizations to oversee audit initiatives for consistent and comprehensive evaluations.

- Prioritize opportunities to educate physicians about coding and billing updates to enhance accuracy.

Embracing data-driven insights:

- Keep an eye on days in accounts receivable (AR) and utilize monthly reports to detect emerging trends promptly.

- Assess your practice’s financial health by monitoring net collection percentage growth.

- Consider an RCM system that traces the entire revenue cycle per patient, from appointment to full payment.

- Focus your efforts on specific areas with significant potential for financial improvement.

- Match patient encounters with actual appointments for precise billing.

Monitoring your benchmarks:

- Regularly review your physician service frequency compared to medical practices to avoid RAC audits looking for unnecessary or false claims.

- Ensure no medical services are incorrectly marked as 100% write-offs.

- Establish a systematic process for addressing claims that are denied or paid incorrectly.

- For larger groups, develop a policy to address consistent poor coding practices among providers.

Avoiding RAC Audits with proactive measures:

- Stay ahead of potential issues by performing regular internal audits.

- Consider involving external medical billing professionals for specialized assistance.

- Pay close attention to evaluation and management services, a common RAC audit target.

- Ensure accuracy in principal diagnoses, medication reports, and high-dollar charges.

- Recognize that internal audits are investments in your practice’s financial success.

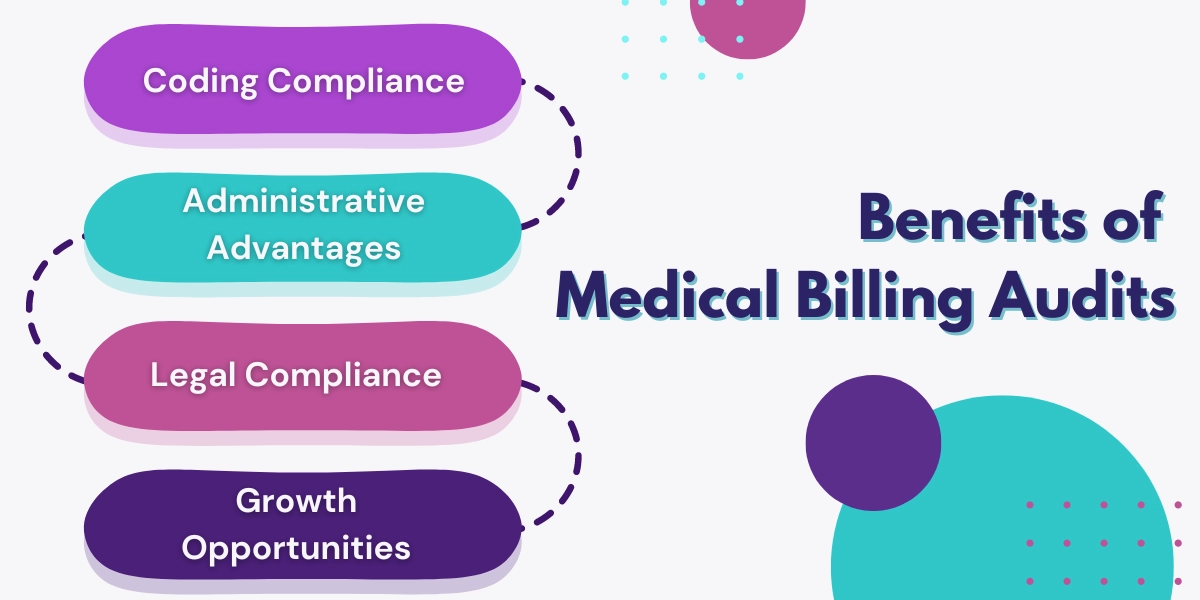

Benefits Of Medical Billing Audits

- Coding compliance: Billing audits are a reliable method for finding mistakes, offering guidance to rectify problems, boosting confidence among coding staff, and ensuring the use of accurate procedure and diagnosis codes. Those conducting the audit can identify areas where staff need education and training to ensure proper coding procedures are followed.

- Administrative advantages: Medical billing audits benefit administrative staff by confirming the accuracy of claims before submission. Issues like under and over-coding, excessive code usage, and incorrect unbundling practices are replaced with accurate billing for services and procedures. When proper policies and procedures are in place and followed, the likelihood of external auditor visits decreases significantly.

- Legal compliance: Medical claims audits help practices safeguard themselves against fraudulent billing and improper claims. Audits can uncover reimbursement gaps and highlight where the practice deviates from the national average due to incorrect coding.

- Growth opportunities: Opportunities for increased reimbursement might also be identified, leading to revenue growth. Additionally, efficient file processing, reduced improper payments, and optimized claim payments further benefit the practice.

Contact Hansei Solutions

If your medical practice is struggling with medical billing audits, contact Hansei Solutions. Our medical billing team can analyze your practice’s medical billing process, identify room for improvement, and implement data-backed solutions that drive growth and revenue. Don’t let your practice slip into bad debt because of undereducated or novice medical billing companies. Call Hansei Solutions to learn about our years of experience helping non-hospital and behavioral facilities focus on patients and not bills.

Ready to focus on providing healthcare? Let us lighten your load.

We’re here to address your pain points and create growth opportunities for your organization. We’re passionate about what we do, and it shows in every interaction. Learn what makes us tick and schedule a demo today.