Blog

When it comes to healthcare, the burden of medical debt often compels people to choose between their physical health and the potential damage to their credit ratings. In the field of behavioral health, this difficulty is particularly highlighted by the intersection of the complex requirements of addiction treatment centers and mental health facilities with the difficulties associated with medical billing.

Understanding the Impact on Credit Scores

Matter of fact; over 3 million people owe $10,000 or more in medical debt, while almost 100 million Americans are in medical debt, according to recent estimates, as the weight of medical bills continues to mount.

Although recent modifications will shield medical collections under $500 from negative effects on credit reports, larger amounts that remain unpaid still have the potential to negatively affect credit scores. With its insights into the changing landscape of healthcare costs, it is crucial to comprehend the complex dance between medical debt and credit scores.

The Dynamics of Credit Impact

As of March 31, 2023, medical collections will not affect credit reports because the $500 threshold has been reached. However, the threat of sizable outstanding debts still affects credit scores. The complex relationship between medical debt and credit emphasizes how important it is for people to have a thorough awareness of how their financial responsibilities may affect their creditworthiness.

Understanding How Medical Bills Impact on Credit

One of the most important strategies to prevent negative effects on credit scores is to pay medical bills on time. Not all healthcare providers report directly to credit bureaus, unlike traditional debt. Instead, a procedure involving collection agencies must be followed for unpaid medical debts, which causes reporting delays. Due to the special nature of medical debt, credit bureaus have instituted a 365-day waiting period before these collections appear on credit reports. This allows for resolution and avoids an immediate negative impact on credit scores.

Preventing Damage to Long-Term Credit

Even though unpaid medical bills might not show up right away on credit reports, there is still a chance that they could cause long-term harm. Accounts for medical collections of more than $500 may appear on credit reports for up to seven years. But there’s a crucial relief: these accounts are quickly deleted after the settlement. The secret is to act quickly to shield credit from long-term harm.

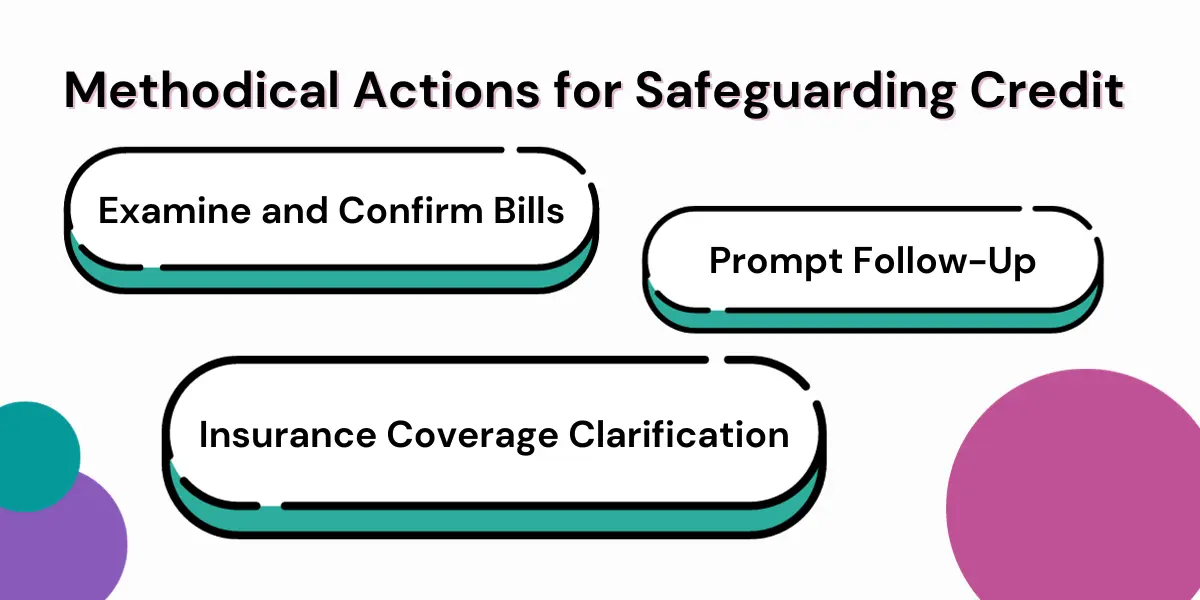

Methodical Actions for Safeguarding Credit

Examine and Confirm Bills: Proactively, medical bills are promptly reviewed to ensure accuracy. To guarantee accurate billing, people should take immediate action to resolve any discrepancies and work with healthcare organizations and insurance companies.

Prompt Follow-Up: To find out whether medical bills have been paid, prompt follow-up is crucial. Prompt correspondence with healthcare providers helps to avoid credit repercussions and keeps bills from going to collections.

Insurance Coverage Clarification: It is important to make clear any delays in insurance payments. Efficient correspondence between insurance companies and healthcare providers guarantees all-inclusive coverage of medical costs, thereby preventing credit problems.

Disputing Errors on Credit Reports

Regular credit report checks, available via websites such as AnnualCreditReport.com, are a preventative approach to finding mistakes in medical collections. If there are any disparities, people should get in touch with credit bureaus, debt collection agencies, and medical providers right away. By presenting proof of errors, collection accounts may be updated or closed, protecting the integrity of your credit report.

The Effects of Resolving Medical Debt

One of the most effective ways to raise credit scores is to pay off valid medical debt. When unpaid medical collection accounts totaling more than $500 are settled, credit benefits right away. The importance of proactive financial management is highlighted by the realization that paying off medical debt can have a transformative effect.

Techniques for Handling Exorbitant Medical Expenses

For those who are struggling with excessive medical expenses, there are several options available. These tactics offer a road map for overcoming financial obstacles related to medical expenses. They range from settling bills and creating repayment schedules to contacting medical billing advocates for support or looking into financial aid options.

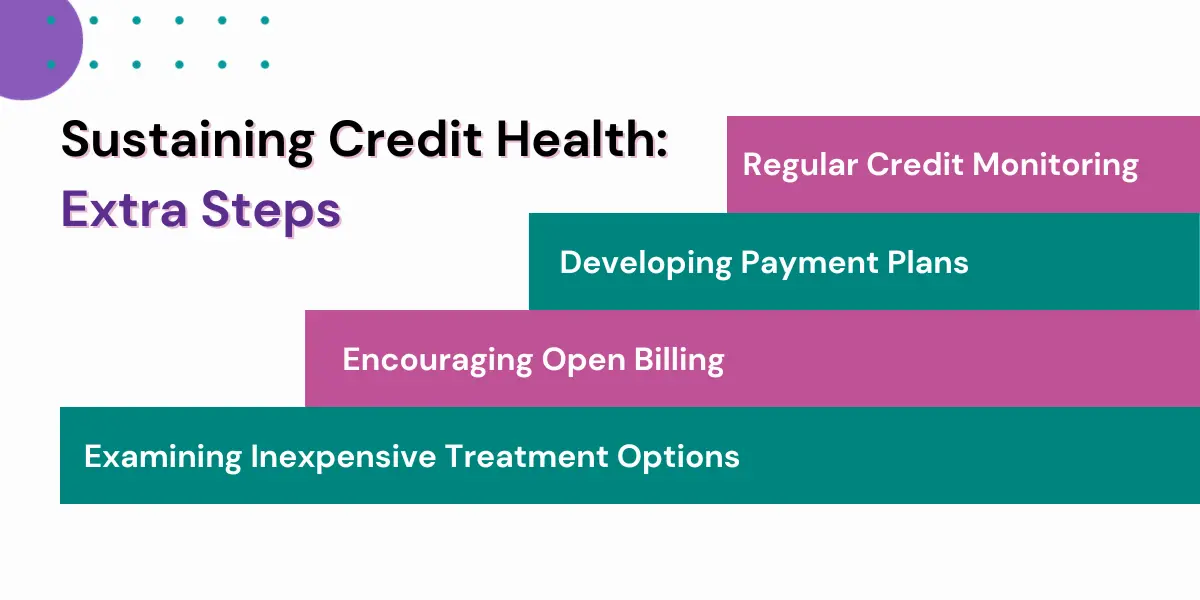

Sustaining Credit Health: Extra Steps

Regular Credit Monitoring: Examining credit reports regularly is an essential way to spot anomalies or possible problems before they become serious. People can stay on top of their credit health with this practice, which is available through websites like AnnualCreditReport.com.

Developing Payment Plans: Working together with healthcare providers to create fair payment plans is a proactive strategy that not only promotes a cooperative relationship but also lessens the possibility of credit issues. The secret to successfully navigating these arrangements is honest communication regarding financial constraints.

Encouraging Open Billing: One of the most important first steps is to push for upfront, clear billing practices. This entails being proactive with financial matters, being aware of potential balance billing, and having a thorough understanding of the cost structure of behavioral health services.

Examining Inexpensive Treatment Options: Investigating and researching less expensive treatment options proactively helps to reduce the chance of unpaid invoices. One way to avoid unanticipated financial burdens is to be aware of the costs involved before scheduling procedures or treatments.

Building Financial Stability in Mental Health through Preventive Measures

When it comes to behavioral health, being informed and proactive is crucial. In addition to protecting credit scores, this strategy fosters a helpful and positive relationship between patients and providers. Proactive communication, awareness, and advocacy enable people receiving addiction and mental health treatment to successfully manage the complex financial components of their medical journey.

The intricate correlation between credit scores and behavioral health expenses is becoming more and more apparent, indicating the need for a comprehensive strategy. Understanding the relationship between behavioral health costs and credit scores requires more than just financial literacy; it also calls for a thorough understanding and a dedication to promoting a mutually beneficial relationship between patients and their healthcare providers.

Ready to focus on providing healthcare? Let us lighten your load.

We’re here to address your pain points and create growth opportunities for your organization. We’re passionate about what we do, and it shows in every interaction. Learn what makes us tick and schedule a demo today.