Blog

Navigating insurance reimbursement can be a complicated process—especially in the behavioral health and addiction treatment space. If you’re an out-of-network provider or a client receiving care at one, you’ve likely come across the term “super bill.” But what exactly is a super bill, and why is it important?

At Hansei Solutions, we support behavioral health providers across the revenue cycle, helping them maximize reimbursements, stay compliant, and streamline operations. In this article, we break down what a super bill is, how it works, and when it’s used in behavioral healthcare.

What Is a Super Bill?

A super bill is a detailed receipt or statement of services that a healthcare provider gives to a patient after an appointment. It includes all the information needed for the patient to file a claim with their insurance company and request reimbursement.

Think of it as a “claim-ready” invoice—designed not for internal records, but for insurance use.

Super Bills Are Most Commonly Used:

- When a provider is out-of-network

- In private pay arrangements

- In cash-pay behavioral health or therapy settings

Rather than billing the insurance company directly, the provider gives the patient a super bill. The patient can then submit it to their insurer for possible reimbursement under their out-of-network benefits.

What’s Included in a Super Bill?

For a super bill to be accepted by insurance companies, it must contain specific information that supports a valid claim. This includes:

Patient Information

- Full name

- Date of birth

- Insurance member ID (optional)

Provider Information

- Name and credentials (e.g., LCSW, MD)

- National Provider Identifier (NPI)

- Tax ID number

- Practice address and contact info

Visit Details

- Date of service

- Duration of session (if relevant)

- Place of service (telehealth, office, facility)

CPT Codes (Procedure Codes)

These describe the services provided, such as:

- 90834 – 45-minute individual therapy

- 90853 – Group therapy

- H0015 – Intensive outpatient treatment

ICD-10 Codes (Diagnosis Codes)

These explain the medical necessity behind the services, such as:

- F32.1 – Major depressive disorder, moderate

- F10.20 – Alcohol dependence, uncomplicated

- F41.1 – Generalized anxiety disorder

Fee Breakdown

- Provider’s fee for each service

- Total amount paid by the patient (if any)

Why Are Super Bills Important in Behavioral Health?

Behavioral health providers—especially those offering therapy, counseling, or addiction treatment—are often out-of-network with many insurance plans. This can be due to payer limitations, reimbursement challenges, or administrative complexity.

In these cases, super bills serve two major purposes:

They Help Clients Access Reimbursement

Even when a provider doesn’t accept insurance directly, clients can still use their out-of-network benefits. A super bill gives them the documentation they need to claim partial reimbursement from their insurance plan.

They Provide Legal and Clinical Documentation

Super bills serve as proof that care was rendered, when, and why. This is important not just for reimbursement, but for compliance and clinical transparency—especially for services involving mental health or substance use treatment.

How Does the Reimbursement Process Work?

Here’s what typically happens:

- Client Pays Out of Pocket

- The client pays the provider at the time of service (or per a cash-pay contract).

- Provider Issues Super Bill

- The provider gives the client a super bill with all required details.

- Client Submits to Insurance

- The client sends the super bill to their insurance company (usually via an online portal or claims address).

- Insurance Processes Claim

- The insurance company reviews the bill, checks the client’s out-of-network benefits, and may reimburse part of the cost directly to the client.

Note: Reimbursement depends on the client’s specific plan, deductible status, and whether the services are deemed medically necessary.

Best Practices for Behavioral Health Providers

To ensure your super bills help clients get reimbursed quickly and accurately, follow these best practices:

- Use Correct Codes: Make sure CPT and ICD-10 codes are valid, appropriate, and up-to-date.

- Ensure Complete Documentation: Include all provider info, service descriptions, and payment amounts.

- Be Transparent About Reimbursement: Make sure clients understand that a super bill doesn’t guarantee insurance payment.

- Consider Partnering with Experts: Hansei Solutions can help you create standardized super bill templates, train staff on billing codes, and optimize your out-of-network billing strategy.

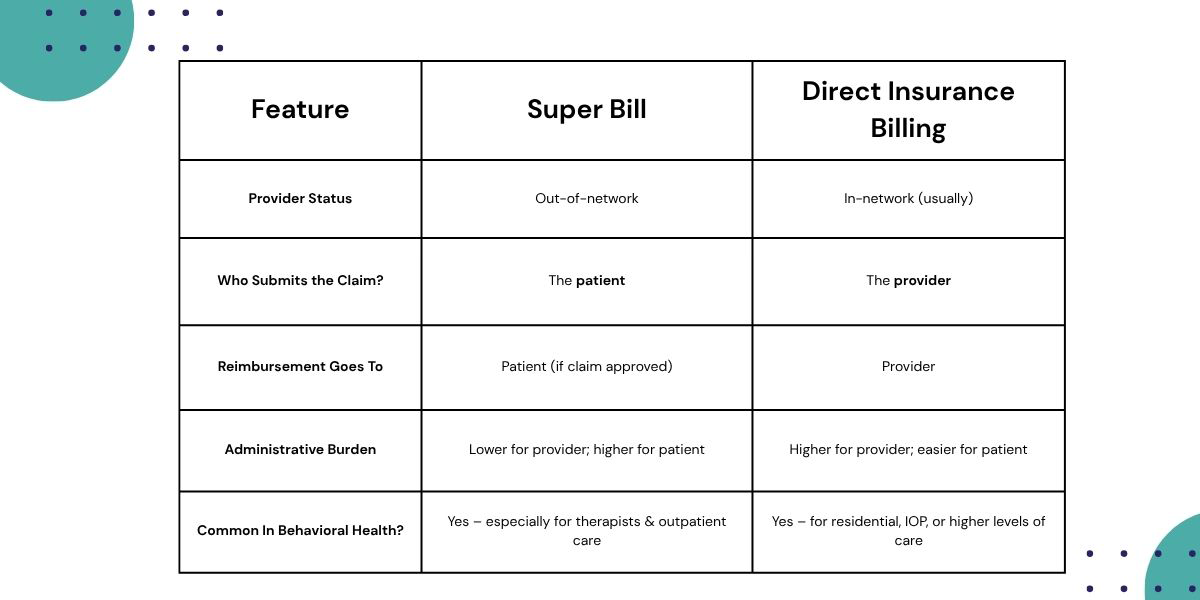

Super Bills vs. Direct Insurance Billing

Simplify the Revenue Cycle with Hansei Solutions

If you’re a behavioral health provider offering out-of-network services, super bills can be a powerful tool for supporting your clients and maintaining a smooth cash flow.

At Hansei Solutions, we help addiction treatment centers and mental health practices streamline billing—from insurance credentialing to reimbursement strategy. We offer:

- Custom super bill templates

- Expert coding support (CPT, ICD-10, DSM-5)

- Claims tracking and denial resolution

- Revenue optimization for both in- and out-of-network models

Need help creating clean, compliant, and client-friendly super bills?

Get in touch with Hansei Solutions to improve your billing workflow and support your clients’ financial recovery—alongside their clinical one.

Ready to focus on providing healthcare? Let us lighten your load.

We’re here to address your pain points and create growth opportunities for your organization. We’re passionate about what we do, and it shows in every interaction. Learn what makes us tick and schedule a demo today.