Blog

Ever wondered what happens after you hand over your insurance card and pay your co-pay at the doctor’s office? Behind the scenes, a critical process called payment posting ensures the payments for your visit end up where they belong. It may sound like a small step in the world of medical billing, but payment posting plays a huge role in keeping healthcare providers financially stable and ensuring that you, the patient, get accurate bills.

Surprisingly, around 80% of medical billing errors stem from payment posting issues. If this process is handled poorly, it can lead to delayed reimbursements, incorrect patient accounts, and lots of frustration. However, when payment posting is done right, it keeps cash flowing, helps providers identify billing issues early, and boosts trust with patients.

What is Payment Posting?

Payment posting is the process of recording payments into a healthcare provider’s billing system. These payments come from a variety of sources, including insurance companies, patients, and government programs like Medicare and Medicaid.

Think of payment posting like balancing a checkbook: every transaction needs to be accurately recorded, verified, and reconciled to ensure everything lines up. When a payment is posted correctly, the patient’s balance is updated, and the provider receives their rightful compensation for services rendered.

There are two main ways payment posting happens:

Manual Payment Posting: This involves a billing staff member entering payment details by hand into the system. While this method offers a personal touch and a chance to double-check each payment, it can be slow and prone to human error. Manual posting works best for smaller practices or when electronic options aren’t available.

Automated Payment Posting: With this approach, payments are posted automatically using electronic remittance advice (ERA). The system updates patient accounts and reconciles payments with minimal human intervention. Automated posting is faster, reduces mistakes, and is perfect for larger practices dealing with a high volume of transactions.

Why is Payment Posting So Important?

You might not think much about what happens after a medical bill is sent, but accurate payment posting is the backbone of a smooth-running healthcare practice. Here’s why it’s so essential:

First, it helps providers identify trends and issues with their payments. By analyzing payment data, practices can spot patterns like frequent denials for specific services or underpayments from certain insurers. This insight helps them adjust their billing processes and improve cash flow.

Second, payment posting reduces errors and discrepancies. When a payment doesn’t match the billed amount, payment posting flags the issue so it can be fixed quickly. According to the American Medical Association (AMA), billing errors cost healthcare providers up to $68 billion annually. Catching these errors early prevents financial losses and reduces the time spent fixing billing mistakes.

Finally, accurate payment posting boosts patient satisfaction. No one likes getting surprise bills or dealing with billing errors. When payments are posted correctly, patients see accurate balances and clear explanations of their charges. This transparency builds trust and reduces the chances of disputes.

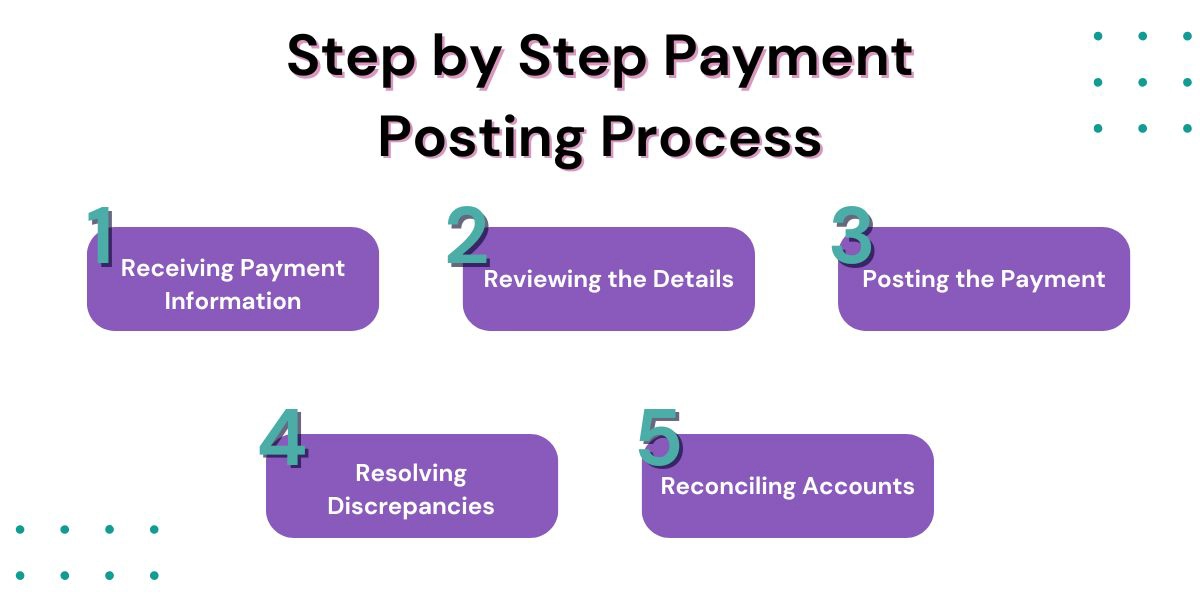

Step by Step Payment Posting Process

The payment posting process follows a series of steps to ensure everything is recorded accurately and efficiently. Here’s how it works:

- Receiving Payment Information: Payments come into the practice through different channels — checks, credit card transactions, or electronic remittance advice (ERA). Each payment is usually accompanied by an Explanation of Benefits (EOB) or Remittance Advice (RA), which outlines the payment details.

- Reviewing the Details: The billing team (or the automated system) reviews the payment information to make sure it matches the EOB or ERA. This step verifies that the amount paid aligns with what was expected.

- Posting the Payment: Payments are recorded in the billing system and applied to the correct patient accounts. This ensures that each patient’s balance is up to date and accurate.

- Resolving Discrepancies: If the payment doesn’t match the billed amount — for example, if there’s an underpayment, denial, or overpayment — the issue is flagged for follow-up. Quick action here helps avoid revenue loss and keeps accounts accurate.

- Reconciling Accounts: The final step is reconciling the payments with bank deposits. This ensures that all payments received are accounted for and correctly reflected in the practice’s financial records.

Common Issues with Payment Posting

Even with the best systems in place, payment posting can still encounter a few bumps in the road. Some common issues include:

- Misapplied Payments: This happens when a payment is posted to the wrong patient or service. It can lead to confusion, incorrect billing, and wasted time fixing the mistake.

- Duplicate Payments: Entering the same payment more than once can throw off financial records and lead to unnecessary reconciliations.

- Denied Claims: If claim denials aren’t addressed promptly, the practice might lose out on revenue. In fact, a lot of denied claims are never resubmitted, meaning significant money is left on the table.

- Incorrect Adjustments: Sometimes, write-offs or adjustments are entered incorrectly, which can distort the practice’s financial picture and cause reporting errors.

Why Efficient Payment Posting is a Game-Changer

Getting payment posting right offers huge benefits for healthcare providers. It ensures that cash keeps flowing, helps avoid costly billing mistakes, and makes life easier for both the billing staff and the patients. When payment posting runs smoothly, providers can spend less time on paperwork and more time caring for their patients.

Efficient payment posting also provides accurate financial data, making it easier to track performance, identify issues, and plan for the future. It reduces the risk of claim denials, helps resolve discrepancies quickly, and improves overall efficiency.

How Hansei Solutions Can Help

At Hansei Solutions, we take the hassle out of payment posting. We know that medical billing is complicated, and small mistakes can lead to big problems. That’s why we offer specialized services to ensure your payment posting is accurate, timely, and stress-free.

Our team focuses on:

- Accurate Payment Reconciliation: We make sure every payment is posted correctly and matched to the right account.

- Fast Claim Resubmissions: When claims are denied, we jump into action to resolve the issue and get them resubmitted.

- Error Reduction: We catch and fix discrepancies before they turn into bigger problems.

- Clear Reporting: Our detailed reports help you stay informed and make smart decisions about your practice’s finances.

Choosing a Partner To Reduce Payment Posting Errors

Payment posting might not get much attention, but it’s a critical piece of the medical billing puzzle. It keeps cash flowing, reduces errors, and helps build trust with patients by ensuring their bills are accurate.

If you’re ready to improve your payment posting process and say goodbye to billing headaches, contact Hansei Solutions today. Our expert team is here to streamline your operations and boost your revenue.

Ready to focus on providing healthcare? Let us lighten your load.

We’re here to address your pain points and create growth opportunities for your organization. We’re passionate about what we do, and it shows in every interaction. Learn what makes us tick and schedule a demo today.