Blog

Table of Contents

Around 24% of medical claims are denied because insurance providers consider them not medically necessary, experimental, or investigational. This can overload healthcare practices and their staff as they simultaneously try to send out medical bills and appeal denied claims. Some healthcare practices will accept these denials and recommend their patients try an alternative treatment plan, even if the original plan was the most effective. This can cause patients to lose trust in your practice’s ability to asses their medical needs, leading to revenue leakage and a poor reputation with patients and payers.

This article explains five ways to prevent medical necessity denials, the most common reasons they’re denied, and how to appeal them yourself or through clinical denial management professionals.

What is Medical Necessity?

Medical necessity includes treatment services covered by a patient’s insurance, considered essential by the healthcare provider and the insurance provider, and following medical standards and regulations. Typically, health plans cover part or all of the expenses for services listed in a patient’s explanation of benefits, which outlines out-of-pocket costs such as out-of-network services, copays, coinsurance, and deductibles. However, these services are required to be:

- Provided for the diagnosis, treatment, cure, or relief of a health condition, disease, disorder, or injury. This also includes some clinical trials, but they must be listed under the explanation of benefits and exclude experimental, investigational, or cosmetic purposes.

- Necessary for and aligned with a diagnosis and its symptoms, and not for the convenience of the insured patient, patient’s family, or healthcare provider. For example, payers usually consider cosmetic surgeries like a nose job or porcelain veneers unnecessary unless a patient’s health is at risk.

These criteria are not meant to replace doctors’ expert opinions. Doctors can still request peer reviews and include them in their appeal letters, which can be used to challenge denials based on “medical necessity.”

What Are Medical Necessity Denials?

Medical necessity denials mean that an insurance provider does not deem a treatment service medically necessary and will usually recommend to the provider to offer their patient an alternative treatment plan covered under their explanation of benefits. However, these denials can also be due to a lack of insight into a patient’s diagnosis or symptoms. They might also be denied because the initial claim was missing proper documentation that explained the procedure, reason for admission or diagnosis, and effectiveness of the treatment.

It’s important to note that medical necessity denial can arise at different stages of a claim.

- During a precertification review, the treatment plan is reviewed before the patient receives any care.

- A concurrent review occurs during treatment to see if it’s still medically necessary.

- A retrospective review occurs after treatment has been provided and analyzes if the services were necessary, experimental, or cosmetic.

Read more: Internal Vs. External Medical Billing Audits

5 Ways To Prevent Medical Necessity Denials

Here are five ways to prevent medical necessity denials and maintain your relationship with payers, as consistently denied claims can cause payers to remove you from their in-network providers.

- Ensure your documentation process is thorough: Poor documentation and lack of specifics are some of the biggest reasons medical bills are denied because of medical necessity. If the payer can’t determine if the treatment was effective or covered under the patient’s plan.

- Ensure your coding team or staff are educated: If your healthcare staff input the improper diagnosis code for a service, chances are the payer will deny the claim. This usually happens because of human error, so it’s important that your staff or coding team is well-versed in payer policies, contracts, and national and local coverage determination, and communicates with the clinical team who provided services.

- Ask for a peer review: If an insurance provider denies your medical claim, request a peer-to-peer review. You’ll either talk with an insurance company’s medical director or another physician in the specialty to review the treatment’s medical necessity. A quality second opinion can strengthen your appeal letter and help overturn the denial.

- Use effective and updated billing software: Poor medical billing software can increase your staff’s workload and slow down the claim submission process. This can lead to errors and subsequent claim denials. If your billing software isn’t updated on current billing codes, your practice will fall behind. To prevent this, look into billing software that covers your specialty and is consistently updated when new codes are added or changed. If you want to outsource your medical billing, look for billing companies that use and are well-versed in the latest software.

- Always submit and receive prior authorizations. As mentioned earlier, payers can deny claims even after treatment has been provided. This can upset patients when they receive an unexpected or larger-than-usual medical bill. Receiving prior authorization decreases the chances of this happening and maintains your patient’s trust in your services and cost of care. After all, if a patient receives different bill amounts for the same treatment, chances are they’ll leave your practice or file a separate lengthy appeal with their payer or legal representation.

Read more: How To Achieve & Maintain Clean Claims For Your Medical Practice

How To Appeal Medical Necessity Denials

In order to appeal a claim denied due to lack of medical necessity, you’ll need to write and file an appeal letter that describes the patient’s condition and references their coverage policy paragraph that emphasizes how your treatment fits the criteria. However, if the insurance provider denies a claim because the treatment does not fall under the patient’s coverage in any way, the appeals process will not apply, and the claim will remain denied until the treatment is changed or adjusted.

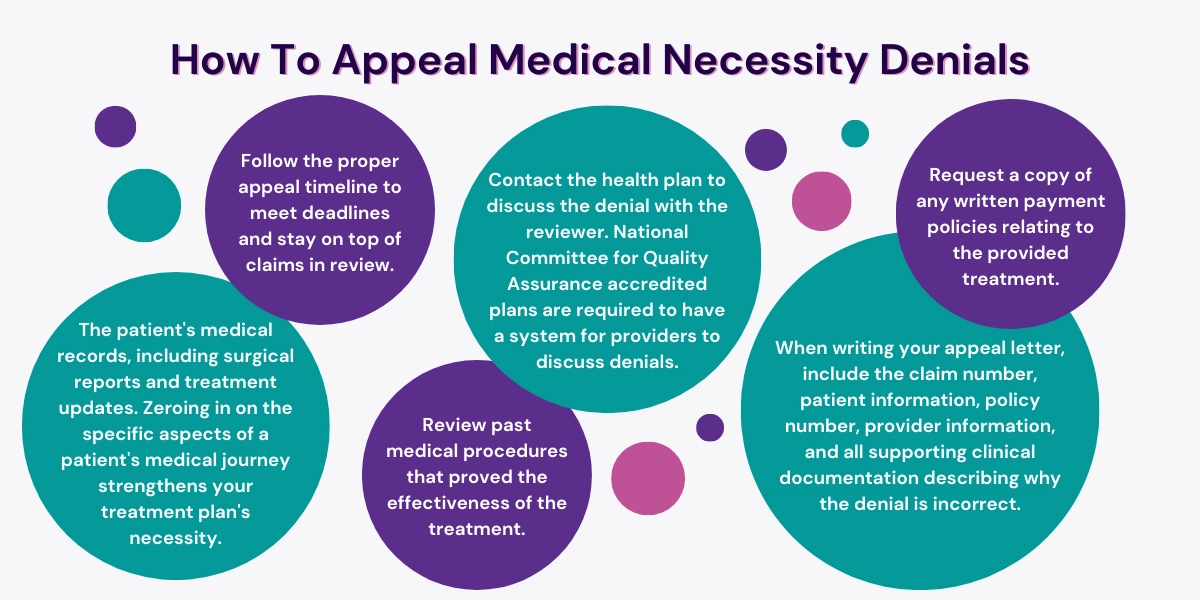

When appealing, most experts suggest reviewing and include the following information in your letter:

- The patient’s medical records, including surgical reports and treatment updates. Zeroing in on the specific aspects of a patient’s medical journey strengthens your treatment plan’s necessity.

- Contact the health plan to discuss the denial with the reviewer. National Committee for Quality Assurance accredited plans are required to have a system for providers to discuss denials.

- Request a copy of any written payment policies relating to the provided treatment.

- Follow the proper appeal timeline to meet deadlines and stay on top of claims in review.

- Review past medical procedures that proved the effectiveness of the treatment.

- When writing your appeal letter, include the claim number, patient information, policy number, provider information, and all supporting clinical documentation describing why the denial is incorrect.

Claim Denial Management With Hansei Solutions

If you want a claim denial management team that can submit and appeal denied claims on your behalf, contact Hansei Solutions. Our medical billing team has decades of combined experience and is well-versed in behavioral health and ambulatory surgery billing services. We’ll review your practice’s denial rates and implement data-driven and advanced industry standards that keep your patients satisfied and your revenue consistent.

Ready to focus on providing healthcare? Let us lighten your load.

We’re here to address your pain points and create growth opportunities for your organization. We’re passionate about what we do, and it shows in every interaction. Learn what makes us tick and schedule a demo today.