Blog

If your medical practice isn’t familiar with provider contracting, this is the article for you. Some doctors and practices are cash-only, but these are rare, and most patients want to use their health insurance plan and avoid paying out-of-pocket for basic check-ups or long-term treatment plans.

This brief article explains why provider contracting is important, how these contracts are formed, how to negotiate better contracts for your practice, and contract red flags you should look out for. These tips will help you secure the most beneficial contracts that keep your practice growing and patients happy.

What Is Provider Contracting?

A provider contract is an agreement between a medical provider, like a doctor or healthcare organization, and a payor, such as an insurance company or government program. It outlines how much the payor will reimburse for covered services for their insured customers and determines whether the provider is in-network. Without this contract, medical providers cannot accept a customer’s insurance plan. There are two types of provider contracts: Fee-for-service and predetermined per-person payment contracts.

- Fee-For-Service Healthcare Contracts: These are the most common, and providers are paid for each service they provide per patient. Different procedures or operations have set amounts, but some healthcare organizations, like hospitals, will use a sliding scale to determine how much a patient will pay based on their income.

- Predetermined Per-Person Payment Healthcare Contracts: In predetermined contracts, also called a capitation model, providers are paid for each person assigned to their care by the insurance company each month. For example, a provider might have 100 patients in their care who have Blue Cross Blue Shield but only see 30 patients in one month. Regardless of the amount of patients they see, the payor still pays the full contract amount. This is similar to retainers for lawyers.

- Other provider contracts include quality incentives, bundled payments, shared savings, and shared risk contracts.

Why Is Provider Contracting Important?

Provider contracting is important because patients want to use their insurance plans when seeking healthcare. With rising healthcare costs across the U.S., medical practices can’t afford to exclude insurance risk and lose hundreds of thousands of insured patients. For example, Blue Cross Blue Shield has over 115 million members, and excluding just one payor can cost your practice untold amounts.

Payor contracts also guarantee a set price providers will receive for their medical services covered by the insurance. Otherwise, providers can go back and forth with out-of-network patients to receive payment. Provider contracting also sets a timeframe for healthcare providers to submit claims for reimbursement and dictates the duration within which payors must process and pay these claims upon receipt.

These contracts also dictate which healthcare services require pre-authorization and medical necessity clauses, which procedures can be appealed if denied, and how many days each party has to notify the other before ending the contract. Remember, most payors are looking to keep their own companies and profits happy, and poorly drafted contracts can result in a medical practice losing hundreds of thousands of dollars. These contracts also highlight what information is needed in a claim to be accepted and can be used as a basis when appealing denied claims that contradict the contract.

Read more: The Negative Effects Of Medical Billing Discrepancies On Your Practice

How Are Provider Contracts Formed?

Provider contracts can be different for each payor, but the general contract process involves:

- The initial request to form a contract.

- The agreement review and credentialing (payors will check your staff’s credentials to ensure they are licensed to treat their carriers). This is the longest part of payor contracting since providers need to send their staff’s qualifications, such as licenses, education, experience, and outside training.

- Correcting, revising, and approving the contract.

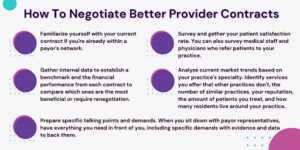

How To Negotiate Better Provider Contracts

Some provider contracts can be unfavorable to medical practices, and several studies highlight the challenges of provider contracting. A Healthcare Financial Management Association survey found that 67% of healthcare providers identified regulatory and reimbursement policies as the number one challenge. Here are the best ways to negotiate and renegotiate contracts with more favorable policies and guidelines.

- Familiarize yourself with your current contract if you’re already within a payor’s network.

- Gather internal data, including reimbursement rates for services from other payors, to establish a benchmark and the financial performance from each contract to compare which ones are the most beneficial or require renegotiation.

- Survey and gather your patient satisfaction rate. Positive patient surveys demonstrate your practice’s ability to provide effective treatment and boost your reputation with payors. You can also survey medical staff and physicians who refer patients to your practice.

- Analyze current market trends based on your practice’s specialty. Identify services you offer that other practices in the same field don’t, the number of similar practices around you, your reputation with other physicians, the amount of patients your practice treats, and how many residents live around your practice.

- Prepare specific talking points and demands. When you sit down with payor representatives, have everything you need in front of you, including specific demands with evidence and data to back them.

Read more: A Beginner’s Guide To End-To-End Revenue Cycle Management

Things To Look Out For

Here are a few things you should look out for when signing a provider contract with a payor.

- Third-Part Administration Terms: These “silent PPOs” result from providers agreeing to a discount service charge agreement and allow the insurer to “sell” or “rent” its in-network providers and this specific service to third-party entities. This can result in an abuse of services and prices.

- Hold Harmless Clauses: These clauses dictate that one or both parties cannot hold the other financially or legally responsible for liabilities. Payors can include these clauses to remove liability from themselves and onto the provider. You always want to negotiate for a mutual clause where each party is held liable.

- Strict Credentialing and Licensure Requirements: Some payors include contract termination clauses that state an entire healthcare practice will lose its in-network status if a single physician’s license is suspended.

- Banned Legal Disputes: Some provider contracts can prevent healthcare practices from seeking legal discourse for unpaid and disputed claims.

- Ambiguous Termination Clauses: Provider contracts should always have clear language that dictates when a contract’s active period ends, how parties can terminate the contract early, and if contracts are automatically renewed until either party begins the termination process.

- Unilateral Amendments: Unilateral amendment clauses allow payors to alter the contract without the provider’s approval or prior notification.

Hansei Solutions & Provider Contract Negotiations

If you want a contract negotiation team that can win favorable provider contracts for your practice, contact Hansei Solutions. We go above and beyond to help our clients improve their medical billing or revenue cycle management. We look out for our clients, and that includes securing better provider contracts with payors to ensure your practice grows and, most of all, your patients have access to quality and affordable healthcare.

Ready to focus on providing healthcare? Let us lighten your load.

We’re here to address your pain points and create growth opportunities for your organization. We’re passionate about what we do, and it shows in every interaction. Learn what makes us tick and schedule a demo today.